The Development Bank of Wales’ first full year has helped even more Welsh businesses to grow.

In the financial year ending March 31, 2019, the Development Bank of Wales invested a total of £80m, an increase of nearly 18 per cent on the year before.

A total of 420 investments were completed across the whole of Wales during the year – 30 per cent more than the previous 12 months.

The development bank’s investments were spread across the country, with £37m invested in South Wales, £26m in mid and West Wales, and £17m in North Wales.

A total of £21m was in equity, a third in 23 companies in the Cardiff equity hot-spot and another £5m in West Wales.

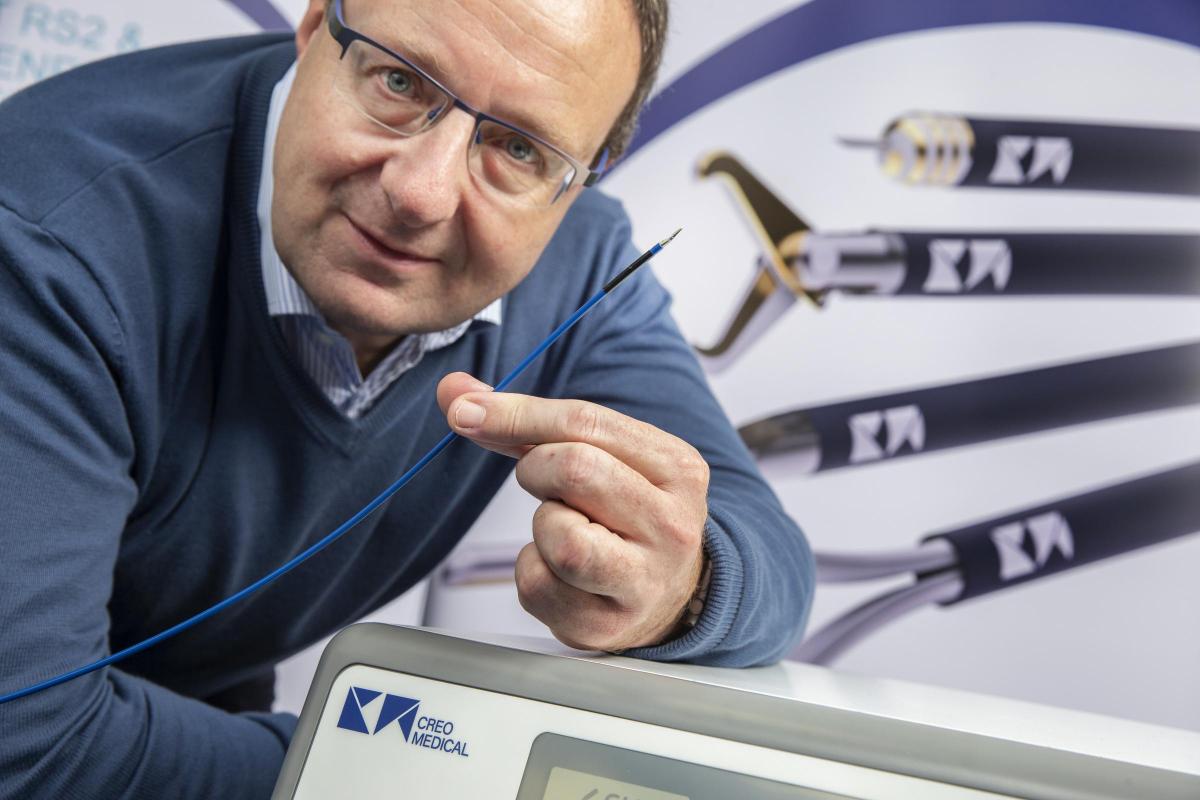

The amount of private sector investment leveraged by the bank’s activities reached £126m, boosted through a share placing by Creo Medical, the Chepstow-based medical equipment company, which raised £46m.

Since extending its loan repayment terms to 10 years, the bank has also seen an increase in demand for patient capital with 97 customers taking advantage of the enhanced terms.

More than 200 micro loans were completed in the year and the rising demand has been attributed to service improvements – loans between £1,000 and £50,000 are now easier to access and businesses that have been trading for two years or more are benefitting from speedier decision making and significantly less paperwork with some lending decisions being made within 48 hours.

There was significant growth in the bank’s challenge to support the property sector in Wales with investments reaching £24m, an increase of 54 per cent on the previous year.

More than 80 per cent of these transactions came from dedicated property funds, the fastest growing part of the bank’s investment activity.

The value of funds to support the construction sector now totals £177m with the launch of the £55m Wales Commercial Property Fund.

Together with other funds raised including the £50m Wales Tourism Fund and the £16m Wales Micro Loan Fund this brings total fundraising for the year close to £200m and more than £430m since it was launched in 2017.

During the year the bank launched Angels Invest Wales alongside the £8m Wales Angel Co-Investment Fund. The refreshed offer gives business access to more than 100 angel investors and syndicates through its online platform. Deals of more than £3m were facilitated in the year.

The bank also secured institutional equity investment for the first time, with £10m being invested by the Clwyd Pension Fund into the Wales Management Succession Fund.

One business the bank has helped is recruitment business ALS Managed Services, which provides an innovative, ethical and sustainable recruitment service to the recycling and warehousing sectors from its headquarters in Caerphilly.

Together with HSBC, the development bank provided a combined funding package of more than £1m, allowing the majority shareholders to exit the business. The transaction saw the bank take a 20 per cent equity stake in the new business, and its investment via the Wales Management Succession Fund allowed ALS to move into new 3,500 sq ft premises and increase its service offering to clients.

Giles Thorley, chief executive of the Development Bank, said: “I am pleased that so many businesses right across Wales have been able to access the right finance to support their journey this year. We have increased our delivery capability and continue to invest in the customer experience as we progress with our business transformation.

"We may be facing a time of uncertainty, but the Development Bank of Wales will be working to ensure that whatever form Brexit may take, Welsh businesses will be supported. I am proud to work with a dedicated team that want to have a positive impact on the Welsh economy.”

Economy and Transport Minister Ken Skates said: “This has been a landmark year for the Development Bank and I congratulate it on achieving its five year annual investment target of £80 million in just eighteen months.

“The bank, both directly and in partnership with Business Wales and private investors, has added significant value to the Welsh economy, with the increased activity in the property market particularly pleasing."

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here