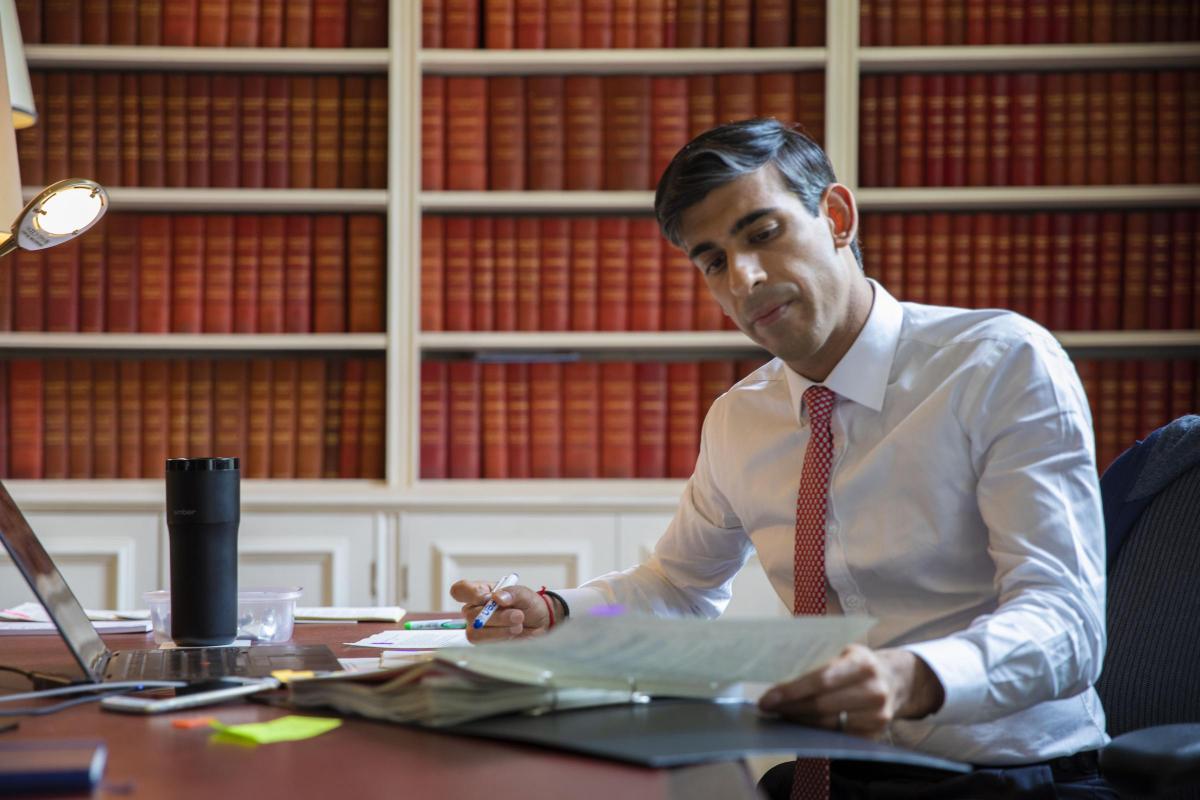

The Chancellor of the Exchequer, Rishi Sunak, has set out the government’s Winter Economy Plan with new job retention measures in a statement to the House of Commons.

Robin Hall, managing director of Newport-based financial services business Kymin, takes a look at what he said.

The Job Support Scheme will support business who are facing lower demand than usual for this time of year due to effects of coronavirus. It is different to the current furlough scheme which comes to an end on October 31, in that employees will need to be working for the company for at least 33 per centof their usual hours.

The company must pay the employee for the hours they work and for every hour not worked, the employer and the government will pay a third each of the employee’s usual pay, which will make sure that the employee earn a minimum of 77 per cent of their normal wages.

The government has capped its contribution to £697.92 per month. The grants will not cover Class 1 employer NICs and pension contributions and at the time of writing it seems that the employer will not be able to top up employee’s wages as has been the case with the furlough scheme.

The scheme is due to start on November 1, 2020 and run for six months, employees needed to be on the payroll before September 23, 2020.

All SMEs with a UK bank account and a UK PAYE scheme will be eligible, larger businesses will also be eligible if their turnover has fallen during the crisis. It will be open to employers even if they have not previously used the furlough scheme.

The Chancellor also announced more support for the self-employed.

He is extending the self-employed grant on similar terms to the Job Support Scheme, it will cover three months’ worth of profits for the period from November to the end of January.

It covers 20 per cent of average monthly profits up to a total of £1,875 and a further grant covering February 2021 to the end of April may be available.

Companies which have used Bounce Back Loans will see the loans extended from six to ten years, which could cut the monthly repayments in half.

Lenders will also be able to extend the length of the Coronavirus Business Interruption Loan Schemes from six to ten years as well. Those businesses struggling with the repayments can choose to make interest only payments for six months and those in “real trouble” can apply to have the repayments suspended completely for six months.

There was also an announcement on taxes, with the 15 per cent emergency VAT cut for tourism and the hospitality industries extended from January 1 to March 31, 2021. Any business which deferred their VAT bills will also be able to pay them back in 11 interest free instalments.

Whether these measures will protect “viable jobs” in the long-term as the chancellor hopes, well only time will tell. A long-term plan with a positive legacy is what is needed, let us hope that before the next six months is up that a clear plan for the future starts to emerge.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here